Outsource Mortgage Loan Setup Support Services

Are you experiencing business sustainability issues because of the dearth of quality talents and looking to transform your day-to-day operations, reduce costs, have an option to scale-up, and digitize your mortgage loan setup process? Are you looking for a comprehensive back-office support solution to cater to your loan setup requirements? If the answer to any of these two questions is a yes, you are in the right place.

At Outsource2india, we offer complete mortgage loan setup services, from collating the loan documents to verifying your borrower's eligibility. We have 27 years of expertise in the mortgage industry and can render routine mortgage assistance to help you save significant costs by providing workforce at a cut-rate.

Mortgage Loan Setup Support Services We Offer

We are one such mortgage loan setup support services in India that have collaborated with retail lenders, investors, wholesale lenders, service providers, and private mortgage insurance companies and have helped them with our state-of-the-art CRM, document management system and a plethora of mortgage loan experts. We provide support services to the following mortgage loan setup solutions -

-

Mortgage Loan Document Management

We can oversee the compilation, inspection, and maintenance of all supporting loan documents, income statements, property purchase agreements. We can also verify that each document meets the latest set of legal requirements.

Our document management services under the mortgage loan setup include verification of all the loan documents such as borrower's authorization, Forms 1003 & 1008, LE, W2s, pay stubs, etc. We also make sure that all the documentation has been filed and compliant with state & federal regulations.

-

Loan Packaging

When you decide on outsourcing mortgage loan setup support services to O2I, we will take care of your loan packaging obligations. Under our loan packaging support services, we can prepare or review the loan applications, which can also be further tailored according to your specific requirements. We can closely work with the loan processors, loan officers, and underwriters to finish the loan package and facilitate it by completing the borrower's profile at the stipulated time. We also review each crucial detail, including employment status, loan eligibility, home insurance policy and credit score before dispatching to the loan originator.

Our mortgage loan setup experts have a solid grasp of the loan accounting process and they are also adept at conveying the financial information with the mortgage and federal laws.

-

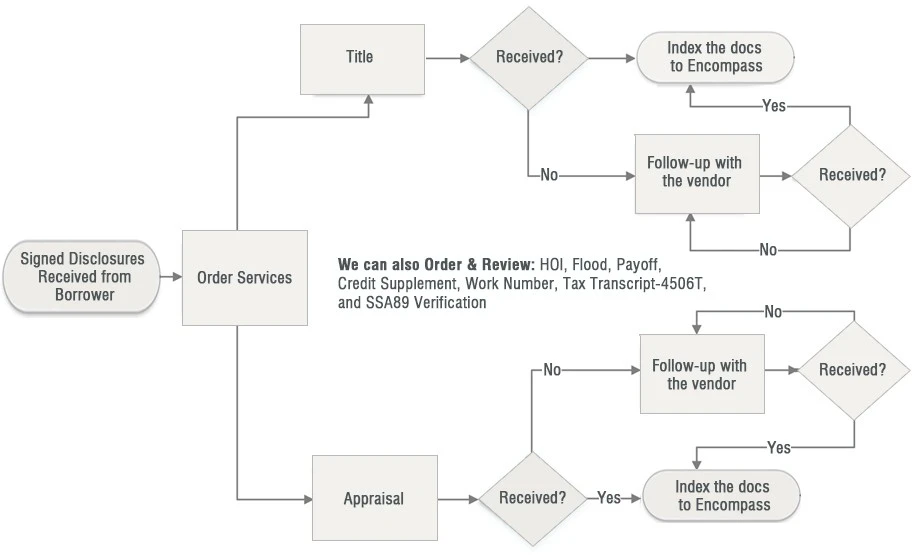

Title Support

Dealing with property titles, which includes financial analysis, title ordering, title transfer, getting property insurance, obtaining the mortgage policy, etc., requires a substantial investment of time & money. This is the reason why as a leading provider of offshore mortgage loan setup support services, we deliver comprehensive title support services, including mortgage title insurance, title research & ordering, title examination, and title commitment.

With us, you can minimize the time, costs & troubles associated with mortgage title services in-house.

-

Appraisal Support

Outsource2india is a foremost mortgage loan setup support services company that provides complete appraisal services from Ordering Appraisals to Appraisal Quality Control. Our back-office appraisal services will help your underwriters to determine the fair market price of the property, thus saving their time & effort. We also deal directly with the appraiser for accuracy and follow-ups. We also review appraisal reports to find any inconsistencies or errors. And all the subtle details like property sales history, location maps, and tax returns are completely evaluated and cross-checked before processing for the further level.

-

Fraud Review

Our mortgage loan setup services comply with the statutory & business rules. We provide fraud detection support, data integrity verification, checking of the loan terms, rates, and related data against the federal lending rules. With our fraud review services, you can distinguish and catalog your borrower's loan files. We make sure that each loan application and the supporting document adheres to the warranties of your mortgage loan and insurance coverage. This helps us recognize any breaches in representations and warranties. We can review the credit bureau report, closing documents, appraisal reports, etc., to ensure the legality & validity of the loan level information.

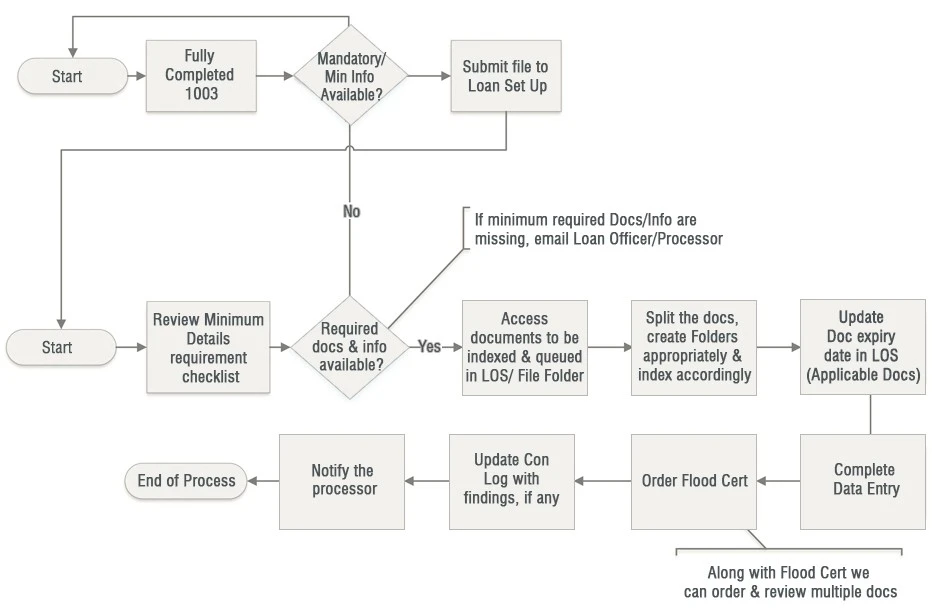

Our Mortgage Loan Setup Process

When you will outsource mortgage loan setup services, we will initiate our collaboration by gathering information on your exact requirements, followed by understanding your workflow, tools you leverage, your borrowers' personas, your staffs' work profiles, and the scale of your mortgage business. This will help us to optimize the time & resources necessary to cater to your mortgage loan setup needs. We follow a validated process to render a compliant, cost-effective, and scalable mortgage loan setup services. Our process includes -

Loan Setup

Service Desk

Mortgage Loan Setup Tools We Leverage

At Outsource2india, we follow a streamlined approach for mortgage loan setup services. Some of the tools we leverage in the process include -

Benefits of Choosing O2I for Mortgage Loan Setup Services

When you are looking for Mortgage loan setup services, we can provide you with a significant advantage over your competitors. At O2I, we ensure compliance friendly back-office mortgage loan setup support through our extensive experience in the mortgage support industry. Here are just a few of the many benefits of outsourcing mortgage loan setup services to us -

-

High Quality

Outsource2inida is an ISO 9001 and ISMS certified organization which assures high-quality mortgage loan setup services. Our loan processing team is highly motivated to help you with your loan setup challenges and inquiries. With their broad knowledge of the mortgage industry, they can connect with your customers emotionally and factually.

-

State-of-the-art Infrastructure

At O2I, our team of mortgage loan setup services executives has access to modern infrastructure in the form of world-class office spaces, uninterrupted network equipment, and the state-of-the-art call center tools and technologies.

-

Multiple Delivery Centers

We have over 10 delivery centers and four global offices. It allows us to collaborate with you efficiently and rendering our services when and where you need. Moreover, our call center executives work day in and day out across all the time zones to cater to your needs and queries.

-

Flexible Pricing Options

You can collaborate with us on the need basis. With our flexible-pricing option, you get the advantage of choosing the scope and duration of the support services from us. Our customized mortgage loan setup services enable us to focus on your pain points.

-

Industry Expertise

We have experienced mortgage professionals who invest their efforts in understanding your challenges and provide their support services to drive your business innovation. With us, you can have access to expert professionals on-demand.

-

24/7 Availability

We work on a 24-hour work cycle, thus giving the benefits of shorter cycle times. Our team of call center support executives is also available 24*7 and when you partner up with us, you can be certain that our contact center executive will always be accessible for calls during your work hours, regardless of the time zone difference.

-

Economy of Scale

With us, you can demand ramp-ups or scale down of the mortgage loan setup support services to manage project demands and budgets; without having to worry about overheads or layoffs.

Other Services You Can Benefit From

Outsource Mortgage Loan Setup Services to Outsource2india

Outsource2india has been a pioneer in providing high-value mortgage loan setup services and a series of other mortgage closing support solutions to its global clientele. At O2I, we have a rich framework of resources & tools to collaborate with mortgage companies worldwide and successfully implement mortgage loan setup solutions.

Our extended suite of mortgage loan setup professionals can provide a high-level of scalability, flexibility, and customizability necessary to boost the mortgage loan setup. We have in-depth knowledge and understanding of the US mortgage and federal laws and continuously evolve and modernize our mortgage outsourcing process to deliver immeasurable value to our clients. Get in touch with us today for reliable, efficient, and cost-effective mortgage loan setup services.

Get a FREE QUOTE!

Decide in 24 hours whether outsourcing will work for you.

Have specific requirements? Email us at: ![]()

USA

116 Village Blvd, Suite 200,

Princeton, NJ 08540

116 Village Blvd, Suite 220, Princeton, NJ 08540

135 Camino Dorado, Suite 7, Napa, CA 94588.